|

THE

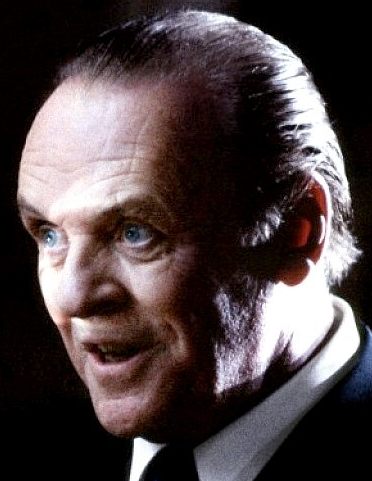

GUARDIAN 2015 - The chairman of HSBC has admitted his shame at the “horrible reputational damage” the bank has suffered following the revelations of the systematic aiding of tax avoidance at its Swiss subsidiary, but has refused to take personal responsibility for the failings.

Douglas Flint, who was finance director at the time HSBC took over the Swiss subsidiary, infuriated members of the Treasury select committee on Wednesday by blaming the failings at the Swiss unit on local managers and said that the secrecy surrounding banking in the country made it difficult for him to have a direct line of sight of what has happening at the bank.

Flint, who has been chairman of the bank since the end of 2010, said: “I believe in personal accountability and I do believe people should be held responsible for what they have direct oversight over when they have failed”.

While he said he felt “very ashamed” of events at the bank, he said he would not forfeit past bonus payments in response, telling MPs: “I don’t feel that proximate to what was happening in the private bank.”

His evidence, given over two hours, largely left unresolved the role of Lord Green, the bank’s chairman at the time. Green was appointed trade minister by

David Cameron despite leaks about the activities of its Swiss subsidiary.

Green, an ordained Tory minister, has steadfastly refused to answer questions in public about the scandal – citing a “point of principle”. He has also, to the anger of some MPs, managed to avoid facing questions on his role either from the media or from the two select committees that have been examining the fallout from the scandal. There is some suggestion that Tories are eager to keep Green from attending a select committee hearing.

On Wednesday, Flint largely blamed the directors of HSBC Group private banking, Chris Meares and Clive Bannister, saying they “certainly bear fairly direct responsibility for what went on in the private bank during their stewardship”.

He added: “Most accountable, I think, are the management in Switzerland. It’s very difficult for people outside Switzerland to get any access to the detailed account-level information in Switzerland. That’s something only the management on the ground can have access to for all the privacy and secrecy reasons.

“The individuals that I think are most accountable both for the data theft and the weakness that allowed that to happen, and for the behaviour that was unacceptable in relation to our standards, were the management on the ground in Switzerland.”

In his most reflective remarks, Flint admitted he had a shared responsibility, adding: “One of the most humbling things that has happened in my career is a recognition of all the things you did not know, and you go and say: ‘What could I have known or what should I have known?’”

Anger at the stance of HSBC was not just confined to the activities of the bank a decade ago, but also its systemic culture of failing its responsibilities.

The Treasury committee chairman, Andrew Tyrie, pointed out the bank was not just facing criticism over its past Swiss subsidiary but over contemporary events, including “interest rate derivative selling, Libor manipulation, Eurobor manipulation, mis-selling mortgages to Fannie Mae and Freddie Mac, Forex rigging, weakness in money laundering, credit default swaps … rigging precious metals” and was involved in “various class action lawsuits over the Bernie Madoff fraud”.

“It’s a terrible list,” Flint admitted.

Stuart Gulliver, HSBC’s chief executive, was also asked about his pay arrangements, but said they had not been intended to avoid tax. He conceded it looked strange that his salary while at HSBC in Hong Kong had been placed into a Panamanian account, but he insisted he had made no tax benefit as a result. He said he had made the arrangement in 1998 purely to hide his salary from HSBC staff who might have been able to see it. “I can understand how people find these kind of arrangements unusual and rather strange,” he said.

Both bankers insisted they had not discussed the activities at HSBC’s Swiss arm with anyone at the Treasury, but said they had held two meetings with HM Revenue and Customs.

Gulliver also said the bank had not used its UK newspaper advertising budget to manipulate editorial coverage, but he said some adverts due to be in the Daily Telegraph had been postponed, not cancelled, when the paper highlighted HSBC’s activities in Jersey.

The

Eastbourne branch of the Hong

Kong Shanghai Bank held an account for a fledgling soft

drinks company for many years without any issues. Things changed

when one of their customers staged a fight with Wealden

District Council, asking Sussex

Police to investigate what appeared to be organised malfeasance

in public office, a serious crime for which the maximum penalty

is life

imprisonment. Sussex police did not investigate, faking an

investigation and subsequent false report to the council's full

committee, about which the police became party to the

malfeasance.

The

police failings happened some years before HSBC

got involved, using anti-money laundering statute to ask

questions that appear to be similar in format and to target one

individual - the person who was making waves for Sussex

police and the planning officers and chief executives of Wealden

District Council. Is that just an unbelievable coincidence?

Little

was the victim of what appears to be a conspiracy to know, but there was a

masonic link lurking in the background in the form of the assistant

district planning officer and his father in law, Bernard

Best, and a councillor who belonged to the Tyrian

Lodge in South Street, just around the corner from the

police station in Grove Road.

The

pattern of questions were first identified in a Contravention

Notice served by Wealden on their target and other organisations

with an interest in 2017. Later, Lloyds

Bank asked a similar series of questions, once again

targeting the same individual about shares that he did not own. Then

HSBC joined in with Peter

McIntyre and Laura Gaughan asking more questions with the same

target in the mix. The branch concerned is/was at: 94 Terminus

Road,

Eastbourne, BN21 3ND.

Prior

to this Barclays

bank has closed an account in what looks to be part of the

same state sanctioned agenda, in a lesser form. But nevertheless

an account was closed despite protestations as to loss. It

remains to be seen if there is any other connection or common

denominator. At the moment it all points one way.

The

objective appears to be to cause a lot of work for the

individual and any concern that he worked for, ultimately to

force the closure of accounts - and so prevent their target from

making money or having any chance of being successful. You might

care to agree that banks are supposed to be supportive of

entrepreneurs, not do their best to put them out of business.

At

first Laura Gaughan tried to interrogate the director of this

company over the telephone.

Before this conversation (that was recorded as evidence) there was a recorded

delivery letter saying to phone to make an appointment to visit

the branch. That was misleading

to say the least. Laura did not want an appointment to talk about

things at the local branch,

she only wanted to fire a series of questions at the director that were

designed to get the director to incriminate herself, without

giving any indication as to what the subject matter was so as to

allow the director to refer to the files for accuracy. Talk

about human rights violations. Has Laura not heard of a person's

miranda rights. Or, in this country, the right to remain silent

as per Article 6. But more

importantly, the right to know what is being leveled at her,

before saying anything that may be misconstrued.

When

the company director realised it was a stitch up, she asked for

the questions in writing. Sure enough, there came a long list of

questions aimed at Mr Nelson

Kruschandl, even mentioning him by

name. The pattern is, as we say, remarkably similar in format, qualifying

as institutionalised discrimination when coupled to the

behaviour of Barclays and Lloyds banks - and of course, Wealden

District Council under the leadership of Charles

Lant, now

Trevor Scott.

The

account expenditures were small purchases that any business

would make and others essential to the cause, in this case

supporting a charity with free administration services.

The

soft drinks company wrote back to Laura

Gaughan asking for clarification of issues, also providing

copy of Wealden's contravention notice and other planning related

documents that proved the the district council had lied to the

Secretary of State in 1987

and 1997.

Ms Gaughan failed to respond to the request for information and

ignoring the letter from the soft drinks company, Peter

McIntyre gave notice that the account would be closed.

HSBC

could not respond to the questions being asked, or admit to

conspiracy to pervert the course of justice, or worse.

Following

this, a

director of the soft drinks company attended the Eastbourne

branch to ask why the company's correspondence had been ignored,

when the account manager, Tim

Austin, tried to explain that all customers were being asked

similar questions. Mr Austin made it plain that he was not privy

to the correspondence, hence could not comment on the letter of complaint.

The complainant makes no bones about Mr Austin, who had been

helpful in the operation of this account over the years. His

reply though was near identical to Ms Gaughan's when she was

asked why the HSBC were asking a similar set of questions to

that Wealden and Lloyds bank had been asking. Ms Gaughan also said

all customers were being asked the same questions. But that

could not possibly be true. Indeed, the level of research and

coordination is suggestive of a dedicated witch

hunt, collectively aimed at destroying the one victim.

On

the other hand, if all customers are being asked the same

questions with a specific target, then are our banks now turning

into a kind of Gestapo like service for Her

Majesty Queen Elizabeth?

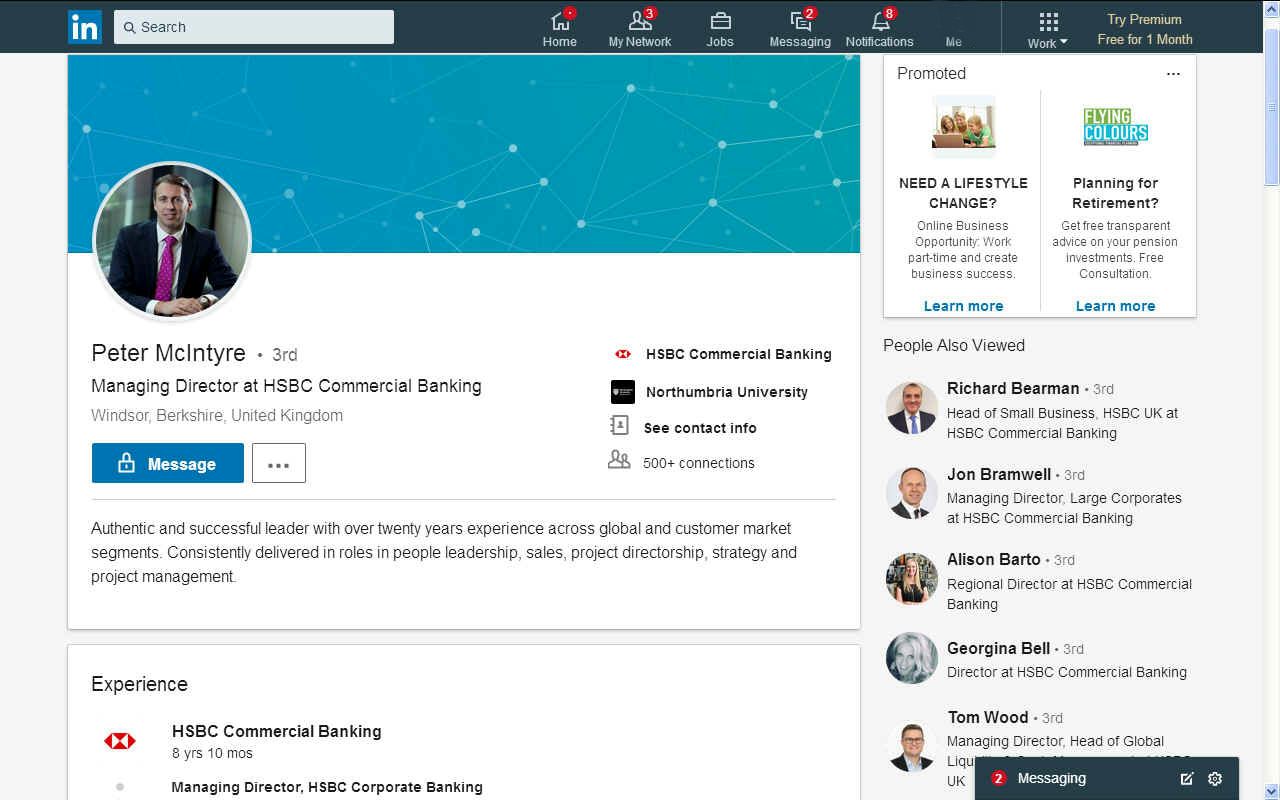

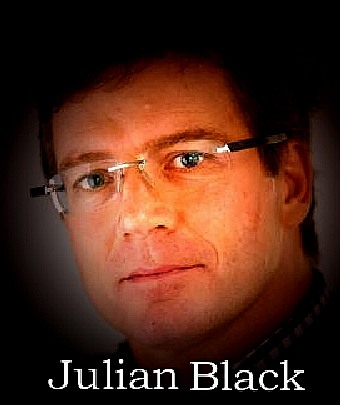

ABOUT

PETER MCINTYRE

According

to his Linkedin

profile, Peter McIntyre Peter McIntyre is the Managing Director at HSBC Commercial Banking

- based at Windsor, Berkshire, United Kingdom. We cannot vouch

for the accuracy of these entries, but assume that the list is

reasonably comprehensive, even if not particularly detailed as

to roles, especially where it may be that he is now putting his

name to closing accounts in circumstances that Financial

Services Ombudsman may decide to investigate in the fullness

of time.

Peter

claims to be an authentic and successful leader with over twenty years experience across global and customer market segments. Consistently delivered in roles in people leadership, sales, project directorship, strategy and project management.

Looking

at his profile, Peter has been in banking at three banks in the United

Kingdom, having graduated from Northumbria University with a

degree in Business Information Technology.

Peter's

Experience

HSBC Commercial Banking

Company Name HSBC Commercial Banking

Total Duration 8 yrs 10 months

Title Managing Director, HSBC Corporate Banking

Dates Employed Nov 2014 – Present

Employment Duration 4 yrs 2 months

Regional Director, South West & Wales

Regional Director for Corporate Banking, South West & Wales region. Responsible for the financial, credit and operational performance for the region for HSBC, accountable for the successful growth of the business as a member of the HSBC Corporate Board.

Leading an engaged and talented growing team, focused on achieving growth through excellent customer satisfaction.

Chair of the National Product Collaboration Board and accountable executive for the ... See more

Title Head of UK Trade, HSBC Commercial Banking

Dates Employed Mar 2012 – Nov 2014

Employment Duration 2 yrs 9 months

Leading the UK Trade business, accountable for the Trade and Guarantees proposition. Led the business through a period of growth, embedding compliance frameworks and establishing a successful and engaged

team, presumably including Laura

Gaughan.

Title Global Head of Product, Supply Chain & Receivables Finance

Dates Employed Mar 2010 – Mar 2012

Employment Duration 2 yrs 1 month

Responsible for the global product strategy, performance and governance for the Open Account proposition globally for HSBC Commercial Banking. Incorporating global expansion and product capability for Receivables Finance and the strategic

evolution of Supply Chain Finance within HSBC.

Cattles Invoice Finance Ltd

Divisional Managing Director

Company Name Cattles Invoice Finance Ltd

Dates Employed Jul 2006 – Oct 2009

Employment Duration 3 yrs 4 months

Board Director, leading the Southern Division of this independent commercial finance company. Accountable for driving strategy and business performance, turning around and growing a business, transforming market brand, position and credibility.

Barclays Corporate Banking

Company Name Barclays Corporate Banking

Total Duration 8 yrs 2 mos

Title Head Of Cash Management

Dates Employed Jun 2004 – Jul 2006

Employment Duration 2 yrs 2 months

Head of UK Sales for strategic growth priority with accountability for investment major investment programme in product and capability. Led an engaged sales culture, focusing resource on value opportunities and winning the largest available mandates in the UK.

Title Risk Programme Director

Dates Employed Jan 2006 – Jun 2006

Employment Duration 6 months

Programme Director reporting directly to the UK Bank Risk Director, completing a current state assessment and subsequent operational remediation plan, leading the Senior Supervisory Group. Accountable to the UK Bank Governance and Control Committee, completed the risk operation at pace with strategic recommendations acknowledged at UK Banking Executive Board.

Lloyds Bank

Business Banking Manager

Company Name Lloyds Bank, South East

Dates Employed Sep 1994 – Jun 1998

Employment Duration 3 yrs 10 months

Peter tells us that he was a graduate entrant into Lloyds Bank, initially covering Retail Banking and Insurance services before

being seconded into Business Banking. After 18 months he was promoted to a leadership role, successfully leading a Business Banking team in the South

East of England.

Nissan Motor Corporation

Purchasing Manager

Company Name Nissan Motor Corporation, Sunderland

Dates Employed Aug 1992 – Jul 1993

Employment Duration 12 months

Placement assigned to the purchasing and supply aspect of just in time continuous improvement

manufacture, staying for 12 months before looking for a career

in banking.

Education

Northumbria University

Degree Name Business Information Technology, BSc (Hons)

Dates attended or expected graduation 1990 – 1994

DAILY

MAIL 17

JULY 2012 - Britain's biggest bank allowed rogue states and drugs cartels to launder billions of pounds through its branches.

HSBC stands accused of fostering such a ‘polluted’ culture it became a conduit for criminal enterprises.

A top executive at the bank sensationally quit yesterday in front of a US Senate hearing that exposed the scale of the scandal.

Following the Barclays rate-fixing revelations, it deals another blow to the City of London’s reputation.

HSBC – one of the few UK banks to survive the financial crisis with its reputation intact – now faces up to £640million in penalties. A devastating 335-page Senate report accused HSBC of ignoring warnings and breaching safeguards that should have stopped the laundering of money from Mexico, Iran and Syria.

The bank failed to monitor a staggering £38trillion of money moving across borders from places that could have posed a risk, including the Cayman Islands and Switzerland. The failures stretched to dealings with Saudi Arabian bank Al Rajhi, which was linked to the financing of terrorism following 9/11.

HSBC’s American arm, HBUS, initially severed all ties with Al Rajhi. But it later agreed to supply the Saudi bank with US banknotes after it threatened to pull all of its business with HSBC worldwide.

According to the report, HBUS also accepted £9.6billion in cash over two years from subsidiaries without checking where the money came from.

In one instance, Mexican and US authorities warned HSBC that £4.5billion sent to the US from its Mexican subsidiary ‘could reach that volume only if they included illegal drug proceeds’.

Concerns over the bank’s links to Mexican drug dealers included £1.3billion stashed in accounts in the Cayman Islands. One HSBC compliance officer admitted the accounts were misused by ‘organised crime’.

London-based banker David Bagley, head of HSBC’s compliance division, which is meant to prevent breaches of the law, quit in front of the Senate committee. He had been with the bank for 20 years.

The affair is also an embarrassment for David Cameron, because his trade envoy Stephen Green chaired HSBC during the period covered by the allegations.

John Mann, a Labour MP on the influential Treasury committee, last night demanded that Lord Green resign or be sacked. ‘Someone whose bank has been assisting murdering drug cartels and corrupt regimes across the world should not be in charge of a government portfolio,’ he said.

A spokesman for the Prime Minister backed the peer – officially known as Baron Green of Hurstpierpoint – saying he was doing an excellent job and would play an important role during the Olympics. No 10 sources said Mr Cameron has not questioned Lord Green about his role in the scandal.

Labour MP Pat McFadden, a member of the Treasury select committee, stopped short of calling for Lord Green to resign over the affair, but said the trade minister should be quizzed over what he knew.

‘I don’t know the timeline of this, but if something was going on at the time anyone was chairman of the bank they should be expected to be asked questions about this,’ he said.

Evidence in the Senate report shows that HSBC staff sought to get round sanctions that prevent American firms doing business with Iran.

It said: ‘From 2001 to 2007, HSBC affiliates sent almost 25,000 transactions involving Iran worth over $19billion (£12billion) through HBUS and other US accounts, while concealing any link with Iran in 85 per cent of the transactions.’

The bank’s compliance division ‘allowed the HSBC affiliates to continue to engage in these practices, which even some within the bank viewed as deceptive, for more than five years without disclosing the extent of the activity to HBUS’.

Many of HSBC’s breaches relate to its use of so-called bearer share accounts, in which ownership of shares and the income they incur can be passed from person to person in secrecy.

Senator Carl Levin, a Michigan Democrat who is leading the investigation, said HSBC had been ‘pervasively

polluted for some time’. He added: ‘Banks that ignore money laundering rules are a big problem for our country.

‘In an age of international terrorism, drug violence in our streets and on our borders, and organised crime, stopping illicit money flows that support those atrocities is a national security imperative.’

In a statement, HSBC said: ‘We will apologise, acknowledge these mistakes, answer for our actions and give our absolute commitment to fixing what went wrong.’

The bank says it has sharpened up its controls and doubled spending on compliance to £255million.

It also said it was closing 20,000 accounts in the Cayman Islands as a result of the investigation.

Saudi terror links

The Senate probe also examined banking HSBC did in Saudi Arabia with Al Rajhi Bank, which the report said has links to financing

terrorism.

Evidence of those links emerged after the Sept 11, 2001 attacks on the United States, the Senate report said, citing U.S. government reports, criminal and civil legal proceedings and media reports.

In 2004, Al Rajhi sued the Wall Street

Journal, which had published an article about U.S. and Saudi authorities monitoring accounts. The article referenced Al Rajhi.

Al Rajhi said in response to a WSJ story that it 'unequivocally condemns terrorism'. Al Rajhi and the paper settled in 2004.

The paper did not pay damages and stated that it 'did not intend to imply an allegation that (Al Rajhi) supported terrorist activity, or had engaged in the financing of terrorism', the Senate report said.

In 2005, HSBC told its affiliates to no longer do business with the bank, the report said. Four months later, HSBC officials reversed course, allowing affiliates to decide whether to continue to do business with Al Rajhi.

A Middle Eastern unit of HSBC continued doing business with the bank, the report said. HSBC ultimately stopped helping the bank handle certain types of transactions, and HSBC compliance officials rebuffed other HSBC bankers seeking to maintain ties to the bank.

Then in late 2006, Al Rajhi threatened to yank all of its business with HSBC unless it regained access to using HSBC's bulk-cash transaction business, the Senate report said.

HSBC agreed to continue to provide the bank bulk shipments of U.S. dollars until 2010 when HSBC exited entirely the bulk-cash business.

Officials at Al Rajhi could not immediately be reached for comment.

Dealings with Iran

Some of the money that moved through HSBC was tied to Iran, the report said, which would violate U.S. prohibitions on transactions tied to it and other sanctioned countries.

To conceal the transactions, HSBC affiliates used a method called 'stripping,' where references to Iran are deleted from records. HSBC affiliates also characterized the transactions as transfers between banks without disclosing the tie to Iran in what the Senate report called a 'cover payment.'

HSBC 'failed to take decisive action to confront these affiliates and put an end to the conduct,' the report said.

Between 2001 and 2007, more than 28,000 transactions were identified by an outside auditor for HSBC that potentially could have run afoul of laws that prohibit transactions with sanctioned countries.

Of those, 25,000 involved Iran. A smaller number required additional analysis to determine if violations of U.S. regulations had occurred, the report said.

At the heart of HSBC's failings was the fact that it served as a hub for smaller financial firms needing access to the global banking system, the report said.

In one example detailed in the Senate investigation, HSBC continued to do business with one client that admitted to

U.S. law enforcement that it had failed to maintain an effective anti-money laundering system.

The client, Sigue Corp, was a money processor in California, the report said. In 2008, the company agreed to a so-called deferred prosecution with the U.S. Justice Department and other U.S. agencies where it admitted to allowing

millions of

dollars of suspect transactions between 2003 and 2005.

Undercover U.S. officers, in a sting, even moved money through the company, explicitly telling Sigue agents they were moving illegal drug proceeds, the report said.

By By Rob Davies and Tim Shipman

Council

civil servants are only one step removed from Nazi Gestapo

officers, but think exactly like the brown shirts that led to World

War Two. The planning system is particularly prone to

breeding workers who develop a power complex and seem to take

delight in what the ordinary man in the street would term

sadistic practices.

EUGENICS

The

United

Kingdom has laws that oppose the concept of a level playing

field, allowing the police, councils and banks to target

individuals and to hound them is such a manner as to prevent

them from succeeding in the commercial world. For example, their

names are flagged up on banking computers,

whereupon the customer is given short shrift and shown the door.

Hence, the victim cannot compete in the commercial world, where

a bank account is a necessity to make purchases online and money

transfers. Given

that everyone should have the right to make a living on equal

terms, this agenda appears to have all the hallmarks of some

kind of secret

society Fourth Reich in the making.

If

the allegations are true, this is discrimination plain and

simple. The kind of discrimination that led to the extermination

of millions of Polish and Jewish people in the Second

World War, after Adolf

Hitler took his empire building and supposed ethnic

cleansing programmes to new industrial heights with the Concentration

Camps that are his legacy.

The

Gestapo were enlisted to round up undesirables and herd them

into the death camps to do forced labour until they either died

of malnutrition or were put into the gas chambers to be

exterminated using Zyklon

B or even just the exhaust fumes from motor

vehicles.

We

wonder if this is a new era of Nazism in a new form. Clearly, if

this kind of targeting of individuals is taking place by way of

an undercurrent of activities by the state aimed at

disadvantaging certain people, Article

14 is being violated along with many other Human

Rights conventions adopted by the United

Nations by way of the Universal

Declaration.

We

await hearing from the HSBC, Lloyds or Barclays and/or any of

their employees (in confidence) should any member of their staff

wish to Blow

the Whistle or otherwise make comment on the above. We are

also keen to hear from any council or police officer as to this

matter.

..

WHO

WE WERE FIGHTING AGAINST FROM 1939 TO 1945

|

Adolf

Hitler

German

Chancellor

|

Herman

Goring

Reichsmarschall

|

Heinrich

Himmler

Reichsführer

|

Joseph

Goebbels

Reich Minister

|

Philipp

Bouhler SS

NSDAP

Aktion T4

|

Dr

Josef Mengele

Physician

Auschwitz

|

|

Martin

Borman

Schutzstaffel

|

Adolph

Eichmann

Holocaust

Architect

|

Rudolf

Hess

Commandant

|

Erwin

Rommel

The

Desert Fox

|

Karl

Donitz

Kriegsmarine

|

Albert

Speer

Nazi

Architect

|

WEALDEN'S

OFFICERS FROM 1983 TO 2018

|

Ian

Kay

Assist.

Dist. Plan.

|

Charles

Lant

Chief

Executive

|

Victorio

Scarpa

Solicitor

|

Timothy

Dowsett

Dist.

Secretary

|

Christine

Nuttall

Solicitor

|

Dr

David Phillips

Enforcement

|

|

Daniel

Goodwin

Chief

Executive

|

J

Douglas Moss

Policy

|

Kelvin

Williams

Dist.

Planning

|

Trevor

Scott

Solicitor

|

David

Whibley

Enforcement

|

Christine

Arnold

Planning

|

|

Chris

Bending

|

Beverley

Boakes

Legal

Secretary

|

Patrick

Coffey

Planning

|

Julian

Black

Planning

|

Ashley

Brown

Dist.

Planning

|

Derek

Holness

|

Abbott

Trevor - Alcock

Charmain - Ditto - Arnold

Chris (Christine) - Barakchizadeh

Lesley - Paul Barker - Bending

Christopher

Black

Julian - Boakes Beverley - Bradshaw

Clifford - Brigginshaw

Marina - Brown

Ashley - Coffey

Patrick - Douglas

Sheelagh

Dowsett Timothy - Flemming

Mike - Forder Ralph - Garrett

Martyn - Goodwin Daniel

- Henham J - Holness

Derek

Hoy

Thomas - Johnson

Geoff - Kavanagh Geoff - Kay Ian - Kay

I. M.

- Barbara Kingsford - Lant Charles - Mercer

Richard

Mileman Niall - Moon

Craig - Moss Douglas, J. - Nuttall

Christine - Pettigrew Rex - Phillips

David - Scarpa

Victorio - Scott

Trevor

Kevin Stewart -

Turner Claire

- Wakeford

Michael. - Whibley David - White,

George - Williams

Kelvin - Wilson Kenneth - White

Steve

The

SS and SA were the special forces used for political purposes.

At this rate it will not be long before all councils in Britain are run by civil

servants who think like Gestapo officers. They might as well cut

out the pretence and wear brown shirts and long black boots.

Heil Hitler! Banks are following suit, targeting individuals and

companies where there is nothing sinister, but simply because

they are out to get a particular person. They have been given

positions of trust and powers that if abused are sure to cause

their victims loss, as per Section 4 of the Fraud

Act 2006.

LINKS

& REFERENCE

http://www.smartsearchuk.com/business-aml-checks

https://www.linkedin.com/in/peter-mcintyre-38063243/

https://www.dailymail.co.uk/news/article-2174785/HSBC-scandal-Britains-biggest-bank-let-drug-gangs-launder-millions--faces-640million-fine.html

https://www.theguardian.com/business/2015/feb/25/hsbc-scandal-horrible-damage-reputation-chairman

https://www.birminghammail.co.uk/news/midlands-news/council-binmen-like-gestapo-former-7061110

http://www.dailymail.co.uk/news/article-1365235/Chelmsford-Council-rubbish-gestapo-fine-nurse-75-black-bag-wheelie-bin.html

|