|

This

Act is used by local authorities to secure a charge on the land of

persons who it is acting against unfavourably.

It is the mechanism by which councils seek to obtain land at an

undervalue for persons in their district who they favour - in denial of

Articles 8, 14 and

17 - knowing full well that we (the

UK) have no Article 13 in

our domestic Human Rights Act 1998. Not having Article 13 effectively

denies any person in England and Wales an effective remedy - where the European

Court of Human Rights is also non-accountable for its decision

making.

Look

then to the Schedule 4 where you will find the all important wording

that explains why it is so important to have policing of corrupt

councils, in this case Wealden

District Council, but you will find that the tactics that Wealden

apply are fostered by the associations that most councils belong to -

hence are widespread practices used for the procurement of land to

order. And that is of course illegal, so a matter for the Sussex Police,

or it would be, but the Sussex Police

appear to be in on it with other MAPPA agencies.

On

reading this Act and cross referencing it with the applicable

Regulations you will realise that bankruptcy is an important part of the

process of by which councils seek to obtain land to order for third

parties. Wealden DC attempted to bankrupt Mr Nelson Kruschandl, a case

that is extremely interesting as a case study to any student setting out

to tackle corruption - by way of organised crime.

APPEAL

COSTS

The

first tactic, also endorsed by the Secretary of State in awarding costs,

is to apply for costs at any appeal hearing. An Englishman's home is not

then his castle, where simply by testing the water as to planning

consent, he or she is liable to fall foul of a costs order leading to a

Land Charge, leading to confiscation of land.

What

happens is that councils, in this case Wealden, seek to obtain costs at

appeal. They frustrate land owners with the intention that such

frustration will cause the target or victim to seek to appeal and then

at that appeal they do their utmost to obtain a Costs Order - with the

intention of using that costs order to Bankrupt their victim.

What is a Local Land Charge

- A Local Land Charge is a restriction or prohibition imposed on a particular piece of land either to secure the payment of a sum of money, or to limit the use of the land. This charge is binding on successive owners and occupiers of the land. The object of the search is to uncover any restrictions or legal obligations against the site. This is to ensure that purchasers of land are not caught unawares by obligations enforceable against successive owners or occupiers of the land by local authorities under the terms of the various statutes.

The Councils have a statutory duty under the Local Land Charges Act 1975 to maintain an accurate and up-to-date register of Local Land Charges affecting land and property in the Wealden District. Details of any Charges that are registered to land and property are, or should be, listed in each Council's Local Land Charges Register.

HOUSE TRAINING

COUNCILS - Making councils obey the law of the land is incredibly

difficult where institutionalized discrimination is rife and there are too

many vested interests for them to be able to do the right thing. We need

then to look at how we train animals not to foul our houses, for guidance

on how to treat officers and members that are well versed in controlling

development to suit their pockets, rather than the pocket of all those

young families that cannot afford to live. We will not even mention the Climate

Change Act 2008, opps! Oh well, now that we have mentioned it, we

wonder where all the zero carbon houses are in Herstmonceux or any other

geographical location in the Wealden district? The answer is that there

are no such developments, because Wealden are too busy greasing

developer's palms rather than meeting the United

Nations targets for climate control. This means that sustainable

development is missing in East Sussex all the while the present

Conservative administration are in power. Does that mean that the

Conservative Party are global warmers. It looks that way. If so,

Conservative party members are partly responsible for the melting ice

caps and disappearance of our coral reefs.

POTTY

TRAINING

In

the case of Mr Kruschandl, (at first like most targets) innocent in

these matters, he was forced to remove washing and toilet facilities.

Wealden went down this route because Mr Kruschandl avoided costs in

several appeals to the Secretary of

State. So frustrated were the officers

of Wealden District Council

by his good fortune that they fell foul of their own strategy to wear

the target down, so petitioned the Court for removal of his potty.

It

cannot be just the officers, for without the approval of the various

Committees and the Cabinet, the officers would be unable to use their

powers to seek to defraud anyone. Hence, it is the Members of any

council who are ultimately the controlling

minds - or at least that is the way it should be in a democracy.

COUNCILLORS

SERVING IN 2017 INTO 2018

Councillor Dick Angel

Heathfield

Nth & Cenrl - Cons

Councillor Kevin Balsdon

Pevensey

and Westham - Cons

Councillor Jo Bentley

Hailsham

South and West - Cons

Councillor Bob Bowdler

Heathfield

East - Cons

Councillor Lin Clark

Pevensey

and Westham - Cons

Deputy

Chairman Standards

Councillor Nicholas Collinson

Hailsham

Central & North - Cons

Portfolio

Community Leadership Human Resources

Councillor Nigel Coltman

Hailsham

Central and North - Cons

Chairman

of Licensing

Councillor Dianne Dear

Pevensey

and Westham - Cons

Dep

Chair of Planning South

Councillor Phil Dixon

Rotherfield

- Conservative

Dep

Chair of Audit Finance

Councillor Pam Doodes

Ninfield

& Hooe with Wartling

Conservative

- Vice-Chairman

Councillor Claire Dowling

Uckfield

Central - Cons

Dep

Ldr Public Health Safety

Councillor Jan Dunk

Heathfield

North & Central - Conservative

Councillor Philip Ede

Alfriston

- Conservative

Councillor Helen Firth

Uckfield

New Town - Cons

Councillor Jonica Fox

Cross-in-Hand/

Five Ashes - Conservative

Councillor Roy Galley

Danehill/

Fletching/ Nutley - Cons

Portfolio

Economic Dev & Waste Man

Councillor Richard Grocock

Hailsham

South and West - Cons

Councillor Chris Hardy

Hartfield

- Cons- Chairman

|

Councillor Jim Hollins

Crowborough

West - Cons

Councillor Peter Holloway

Forest

Row - Conservative

Councillor Johanna Howell

Frant/

Withyham - Cons

Ch

Planning North

Councillor Toby Illingworth

Buxted

& Maresfield - Cons

Councillor Stephen Isted

Crowborough

Jarvis Brook - Independent

Councillor Andy Long

Herstmonceux

- Cons

Councillor Michael Lunn

Buxted

& Maresfield - Cons

Councillor Philip Lunn

Crowborough

East - Cons

Councillor Barry Marlowe

Uckfield

Ridgewood - Cons

Dep

Ch Licensing

Councillor Rowena Moore

Forest

Row - Conservative

Councillor Kay Moss

Crowborough

St Johns - Cons

Dep

Chair Overview & Scrutiny

Councillor Douglas Murray

Willingdon

- Conservative

Councillor Ann Newton

Framfield

- Cons

Portfolio

Planning & Dev

Councillor Amanda O'Rawe

Hailsham

East - Conservative

Councillor Mark Pinkney

Hellingly

- Conservative

Councillor Dr Brian Redman

Mayfield

- Conservative

Chairman

of Standards Committee

Councillor Ronald Reed

Crowborough

North - Conservative

Councillor Carol Reynolds

Uckfield

North - Cons

|

Councillor Greg Rose

Crowborough

East - Cons

Chair

Overview & Scrutiny

Councillor Peter Roundell

Danehill/

Fletching/ Nutley - Cons

Chairman

Audit Finance

Councillor William Rutherford

Frant/

Withyham - Cons

Councillor Daniel Shing

Polegate

South - Ind Democrat

Councillor Oi Lin Shing

Polegate

North - Ind Democrat

Councillor Raymond Shing

Willingdon

- Independent Democrat

Councillor Stephen Shing

Willingdon

- Independent Democrat

Councillor Angela Snell

Polegate

North - Conservative

Councillor Robert Standley

Wadhurst

- Conservative

Leader

of the Council

Councillor Susan Stedman

Horam

- Conservative

Chair

Planning South

Councillor Roger Thomas

Heathfield

North & Central - Cons

Councillor Jeannette Towey

Crowborough

West - Cons

Councillor Chriss Triandafyllou

Hailsham

South and West - Cons

Councillor Peter Waldock

Uckfield

North - Cons

Councillor Neil Waller

Crowborough

North - Cons

Dep

Chair Planning North

Councillor David Watts

Chiddingly

& East Hoathly - Cons

Councillor Graham Wells

Wadhurst

- Cons

Portfolio

Housing & Benefits

Councillor David White

Hellingly

- Independent

Councillor John Wilton

East

Dean - Conservative

|

Dick Angel

- Jo Bentley

- John Blake - Bob

Bowdler - Don Broadbent

- Norman Buck - Raymond Cade -

John Carvey

- Lin Clark

Nicholas Collinson - Nigel Coltman - Ronald Cussons -

Barby Dashwood-Morris

- Dianne Dear

- Phil Dixon - Pam Doodes

Claire Dowling

-

Jan Dunk

- Louise Eastwood - Philip Ede - Helen Firth -

Jonica Fox

- Roy Galley -

Richard Grocock - Chris Hardy

Steve Harms

-

Jim Hollins - Peter Holloway - Johanna Howell -

Stephen Isted - David Larkin -

Andy Long - Michael Lunn

Barry Marlowe -

Nigel McKeeman - Huw Merriman - Rowena Moore -

Kay Moss - Douglas

Murray - Ann Newton - Ken Ogden

Amanda

O'Rawe - Charles R Peck

- Diane Phillips - Mark Pinkney - Major Antony Quin RM -

Ronald Reed - Dr. Brian Redman

Carol Reynolds -

Greg Rose - Peter Roundell

- William Rutherford -

Daniel Shing

- Oi Lin Shing - Raymond Shing -

Stephen Shing

Robert Standley -

Susan Stedman -

Bill Tooley - Jeanette Towey - Stuart Towner - Chriss Triandafyllou -

Peter Waldock

Neil Waller

- David Watts - Mark Weaver -Graham Wells -

David White - John Wilton

DOUBLE

EDGED SWORD

The

law works both ways. If you ask for and obtain any Order that is

illegal, it may be challenged in the High Court and this is what the

appellant did, appearing in front of Dame

Butler-Sloss, a senior judge who ordered toilet removal but then

knowing the Health

& Safety Regulations 1992 would come back to bite in any appeal

to the Supreme Court, then suggested that the toilets could be

re-installed after compliance with the Order of Mrs Justice Steele. This

was a clever move on the part of Dame Elizabeth, but the justice system

cannot escape the consequences of the High Court making an order that

the Courts had no power to make - save for conspiring with Wealden to pervert

the course of justice. Any deviation from what is just and right is a

perversion.

1972 CHAPTER 61

An Act to consolidate certain enactments relating to the registration of land charges and other instruments and matters affecting land.

[9th August 1972]

Be it enacted by the Queen's most Excellent

Majesty, by and with the advice and consent of the Lords Spiritual and Temporal, and Commons, in this present Parliament assembled, and by the authority of the same, as follows:—

Preliminary

1 The registers and the index

(1) The registrar shall continue to keep at the registry in the prescribed manner the following registers, namely—

(a) a register of land charges ;

(b) a register of pending actions ;

(c) a register of writs and orders affecting land ;

(d) a register of deeds of arrangement affecting land ;

(e) a register of annuities,

and shall also continue to keep there an index whereby all entries made in any of those registers can readily be traced.

(2) Every application to register shall be in the prescribed form and shall contain the prescribed particulars.

(3) Where any charge or other matter is registrable in more than one of the registers kept under this Act or is registrable in one or more of those registers and also in a register kept under the Land Charges Act 1925 (registers of local land charges), it shall be sufficient if it is registered in one register, and if it is so registered the person entitled to the benefit of it shall not be prejudicially affected by the provisions of this Act or that Act applying to any other register.

(4) Schedule 1 to this Act shall have effect in relation to the register of annuities.

(5) An office copy of an entry in any register kept under this section shall be admissible in evidence in all proceedings and between all parties to the same extent as the original would be admissible.

(6) Subject to the provisions of this Act, registration may be vacated pursuant to an order of the court.

(7) In this section " index" includes any device or combination of devices serving the purpose of an index.

3 Registration of land charges

(1) A land charge shall be registered in the name of the estate owner whose estate is intended to be affected.

(2) A land charge registered before 1st January 1926 under any enactment replaced by the Land Charges Act 1925 in the name of a person other than the estate owner may remain so registered until it is registered in the name of the estate owner in the prescribed manner.

(3) A puisne mortgage created before 1st January 1926 may be registered as a land charge before any transfer of the mortgage is made.

(4) The expenses incurred by the person entitled to the charge in registering a land charge of Class A, Class B or Class C (other than an estate contract) or by the Board in registering an Inland Revenue charge shall be deemed to form part of the land charge, and shall be recoverable accordingly on the day for payment of any part of the land charge next after such expenses are incurred.

(5) Where a land charge is not created by an instrument, short particulars of the effect of the charge shall be furnished with the application to register the charge.

(6) An application to register an Inland Revenue charge shall state the duties in respect of which the charge is claimed and, so far as possible, shall define the land affected, and such particulars shall be entered or referred to in the register.

(7) In the case of a land charge for securing money created by a company before 1st January 1970 or so created at any time as a floating charge, registration under any of the enactments mentioned in subsection (8) below shall be sufficient in place of registration under this Act, and shall have effect as if the land charge had been registered under this Act.

(8) The enactments referred to in subsection (7) above are section 93 of the Companies (Consolidation) Act 1908, section 79 of the Companies Act 1929 and section 95 of the Companies Act 1948.

4 Effect of land charges and protection of purchasers

(1) A land charge of Class A (other than a land improvement charge registered after 31st December 1969) or of Class B shall, when registered, take effect as if it had been created by a deed of charge by way of legal mortgage, but without prejudice to the priority of the charge.

(2) A land charge of Class A created after 31st December 1888 shall be void as against a purchaser of the land charged with it or of any interest in such land, unless the land charge is registered in the register of land charges before the completion of the purchase.

(3) After the expiration of one year from the first conveyance occurring on or after 1st January 1889 of a land charge of Class A created before that date the person entitled to the land charge shall not be able to recover the land charge or any part of it as against a purchaser of the land charged with it or of any interest in the land, unless the land charge is registered in the register of land charges before the completion of the purchase.

(4) If a land improvement charge was registered as a land charge of Class A before 1st January 1970, any body corporate which, but for the charge, would have power to advance money on the security of the estate or interest affected by it shall have that power notwithstanding the charge.

(5) A land charge of Class B and a land charge of Class C (other than an estate contract) created or arising on or after 1st January 1926 shall be void as against a purchaser of the land charged with it, or of any interest in such land, unless the land charge is registered in the appropriate register before the completion of the purchase.

(6) An estate contract and a land charge of Class D created or entered into on or after 1st January 1926 shall be void as against a purchaser for money or money's worth of a legal estate in the land charged with it, unless the land charge is registered in the appropriate register before the completion of the purchase.

(7) After the expiration of one year from the first conveyance occurring on or after 1st January 1926 of a land charge of Class B or Class C created before that date the person entitled to the land charge shall not be able to enforce or recover the land charge or any part of it as against a purchaser of the land charged with it, or of any interest in the land, unless the land charge is registered in the appropriate register before the completion of the purchase.

(8) A land charge of Class F shall be void as against a purchaser of the land charged with it, or of any interest in such land, unless the land charge is registered in the appropriate register before the completion of the purchase.

Registration in registers of pending actions, writs and orders and deeds of arrangement

5 The register of pending actions

(1) There may be registered in the register of pending actions—

(a) a pending land action ;

(b) a petition in bankruptcy filed on or after 1st January 1926.

(2) Subject to general rules under section 16 of this Act, every application for registration under this section shall contain particulars of the title of the proceedings and the name, address and description of the estate owner or other person whose estate or interest is intended to be affected.

(3) An application for registration shall also state—

(a) if it relates to a pending land action, the court in which and the day on which the action was commenced ; and

(b) if it relates to a petition in bankruptcy, the court in which and the day on which the petition was filed.

(4) The registrar shall forthwith enter the particulars in the register, in the name of the estate owner or other person whose estate or interest is intended to be affected.

(5) An application to register a petition in bankruptcy against a firm shall state the names and addresses of the partners, and the registration shall be effected against each partner as well as against the firm.

(6) No fee shall be charged for the registration of a petition in bankruptcy if the application for registration is made by the registrar of the court in which the petition is filed.

(7) A pending land action shall not bind a purchaser without express notice of it unless it is for the time being registered under this section.

(8) A petition in bankruptcy shall not bind a purchaser of a legal estate in good faith, for money or money's worth, without notice of an available act of bankruptcy, unless it is for the time being registered under this section.

(9) As respects any transfer or creation of a legal estate, a petition in bankruptcy which is not for the time being registered under this section shall not be notice or evidence of any act of bankruptcy alleged in the petition.

(10) The court, if it thinks fit, may, upon the determination of the proceedings, or during the pendency of the proceedings if satisfied that they are not prosecuted in good faith, make an order vacating a registration under this section, and direct the party on whose behalf it was made to pay all or any of the costs and expenses occasioned by the registration and by its vacation.

6 The register of writs and orders affecting land

(1) There may be registered in the register of writs and orders affecting land—

(a) any writ or order affecting land issued or made by any court for the purpose of enforcing a judgment or recognisance;

(b) any order appointing a receiver or sequestrator of land ;

(c)any receiving order in bankruptcy made on or after 1st January 1926, whether or not it is known to affect land.

(2) Every entry made pursuant to this section shall be made in the name of the estate owner or other person whose land, if any, is affected by the writ or order registered.

(3) No fee shall be charged for the registration of a receiving order in bankruptcy if the application for registration is made by an official receiver.

(4) Except as provided by subsection (5) below and by section 36(3) of the Administration of Justice Act 1956 and section

142 (3) of the County Courts Act 1959 (which make special provision as to receiving orders in respect of land of judgment debtors) every such writ and order as is mentioned in subsection (1) above, and every delivery in execution or other proceeding taken pursuant to any such writ or order, or in obedience to any such writ or order, shall be void as against a purchaser of the land unless the writ or order is for the time being registered under this section.

(5) A receiving order in bankruptcy shall be void as against a purchaser of a legal estate in good faith for money or money's worth, without notice of an available act of bankruptcy, unless it is for the time being registered under this section.

(6) Where a petition in bankruptcy has been registered under section 5 above, the title of the trustee in bankruptcy shall be void as against a purchaser of a legal estate in good faith for money or money's worth without notice of an available act of bankruptcy claiming under a conveyance made after the date of registration, unless at the date of the conveyance either the registration of the petition is in force or a receiving order on the petition is registered under this section.

7The register of deeds of arrangement affecting land

(1) A deed of arrangement affecting land may be registered in the register of deeds of arrangement affecting land, in the name of the debtor, on the application of a trustee of the deed or a creditor assenting to or taking the benefit of the deed.

(2) Every deed of arrangement shall be void as against a purchaser of any land comprised in it or affected by it unless it is for the time being registered under this section.

8 Expiry and renewal of registrations

A registration under section 5, section 6 or section 7 of this Act shall cease to have effect at the end of the period of five years from the date on which it is made, but may be renewed from time to time and, if so renewed, shall have effect for five years from the date of renewal.

Searches and official searches - 9 Searches

(1) Any person may search in any register kept under this Act on paying the prescribed fee.

(2) Without prejudice to subsection (1) above, the registrar may provide facilities for enabling persons entitled to search in any such register to see photographic or other images or copies of any portion of the register which they may wish to examine.

10 Official searches

(1) Where any person requires search to be made at the registry for entries of any matters or documents, entries of which are required or allowed to be made in the registry by this Act, he may make a requisition in that behalf to the registrar, which may be either—

(a) a written requisition delivered at or sent by post to the registry; or

(b) a requisition communicated by teleprinter, telephone or other means in such manner as may be prescribed in relation to the means in question, in which case it shall be treated as made to the registrar if, but only if, he accepts it;

and the registrar shall not accept a requisition made in accordance with paragraph (b) above unless it is made by a person maintaining a credit account at the registry, and may at his discretion refuse to accept it notwithstanding that it is made by such a person.

(2) The prescribed fee shall be payable in respect of every requisition made under this section; and that fee—

(a) in the case of a requisition made in accordance with subsection (1)(a) above, shall be paid in such manner as may be prescribed for the purposes of this paragraph unless the requisition is made by a person maintaining a credit account at the registry and the fee is debited to that account;

(b) in the case of a requisition made in accordance with subsection (1)(b) above, shall be debited to the credit account of the person by whom the requisition is made.

(3) Where a requisition is made under subsection (1) above and the fee payable in respect of it is paid or debited in accordance with subsection (2) above, the registrar shall thereupon make the search required and—

(a) shall issue a certificate setting out the result of the search; and

(b) without prejudice to paragraph (a) above, may take such other steps as he considers appropriate to communicate that result to the person by whom the requisition was made.

(4) In favour of a purchaser or an intending purchaser, as against persons interested under or in respect of matters or documents entries of which are required or allowed as aforesaid, the certificate, according to its tenor, shall be conclusive, affirmatively or negatively, as the case may be.

(5) If any officer, clerk or person employed in the registry commits, or is party or privy to, any act of fraud or collusion, or is wilfully negligent, in the making of or otherwise in relation to any certificate under this section, he shall be guilty of an offence and shall be liable on conviction on indictment to imprisonment for a term not exceeding two years, or on summary conviction to imprisonment for a term not exceeding three months or to a fine not exceeding £20, or to both such imprisonment and fine.

(6) Without prejudice to subsection (5) above, no officer, clerk or person employed in the registry shall, in the absence of fraud on his part, be liable for any loss which may be suffered—

(a) by reason of any discrepancy between—

(i) the particulars which are shown in a certificate under this section as being the particulars in respect of which the search for entries was made, and

(ii) the particulars in respect of which a search for entries was required by the person who made the requisition; or

(b) by reason of any communication of the result of a search under this section made otherwise than by issuing a certificate under this section.

Miscellaneous and supplementary

11Date of effective registration and priority notices

(1) Any person intending to make an application for the registration of any contemplated charge, instrument or other matter in pursuance of this Act or any rule made under this Act may give a priority notice in the prescribed form at least the relevant number of days before the registration is to take effect.

(2) Where a notice is given under subsection (1) above, it shall be entered in the register to which the intended application when made will relate.

(3) If the application is presented within the relevant number of days thereafter and refers in the prescribed manner to the notice, the registration shall take effect as if the registration had been made at the time when the charge, instrument or matter was created, entered into, made or arose, and the date at which the registration so takes effect shall be deemed to be the date of registration.

(4) Whereto) any two charges, instruments or matters are contemporaneous ; and

(b) one of them (whether or not protected by a priority notice) is subject to or dependent on the other; and

(c) the latter is protected by a priority notice,

the subsequent or dependent charge, instrument or matter shall be deemed to have been created, entered into or made, or to have arisen, after the registration of the other.

(5) Where a purchaser has obtained a certificate under section 10 above, any entry which is made in the register after the date of the certificate and before the completion of the purchase, and is not made pursuant to a priority notice entered on the register on or before the date of the certificate, shall not affect the purchaser if the purchase is completed before the expiration of the relevant number of days after the date of the certificate.

(6) The relevant number of days is—

(a) for the purposes of subsections (1) and (5) above, fifteen;

(b) for the purposes of subsection (3) above, thirty. or such other number as may be prescribed; but in reckoning the relevant number of days for any of the purposes of this section any days when the registry is not open to the public shall be excluded.

12 Protection of solicitors, trustees, etc.

A solicitor, or a trustee, personal representative, agent or other person in a fiduciary position, shall not be answerable—

(a) in respect of any loss occasioned by reliance on an office copy of an entry in any register kept under this Act;

(b) for any loss that may arise from error in a certificate under section 10 above obtained by him.

13 Saving for overreaching powers

(1) The registration of any charge, annuity or other interest under this Act shall not prevent the charge, annuity or interest being overreached under any other Act, except where otherwise provided by that other Act.

(2) The registration as a land charge of a puisne mortgage or charge shall not operate to prevent that mortgage or charge being overreached in favour of a prior mortgagee or a person deriving title under him where, by reason of a sale or foreclosure, or otherwise, the right of the puisne mortgagee or subsequent chargee to redeem is barred.

14Exclusion of matters affecting registered land or created by instruments necessitating registration of land

(1) This Act shall not apply to instruments or matters required to be registered or re-registered on or after 1st January 1926, if and so far as they affect registered land, and can be protected under the Land Registration Act 1925 by lodging or registering a creditor's notice, restriction, caution, inhibition or other notice.

(2) Nothing in this Act imposes on the registrar any obligation to ascertain whether or not an instrument or matter affects registered land.

(3) Where an instrument executed on or after 27th July 1971 conveys, grants or assigns an estate in land and creates a land charge affecting that estate, this Act shall not apply to the land charge, so far as it affects that estate, if under section 123 of the Land Registration Act 1925 (effect of that Act in areas where registration is compulsory) the instrument will, unless the necessary application for registration under that Act is made within the time allowed by or under that section, become void so far as respects the conveyance, grant or assignment of that estate.

15 Application to the Crown

(1) This Act binds the Crown, but nothing in this Act shall be construed as rendering land owned by or occupied for the purposes of the Crown subject to any charge to which, independently of this Act, it would not be subject.

(2) References in this Act to restrictive covenants include references to any conditions, stipulations or restrictions imposed on or after 1st January 1926, by virtue of section 137 of the Law of Property Act 1922, for (the protection of the amenities of royal parks, gardens and palaces.

16General rules

(1) The Lord Chancellor may, with the concurrence of the Treasury as to fees, make such general rules as may be required for carrying this Act into effect, and in particular—

(a) as to forms and contents of applications for registration, modes of identifying where practicable the land affected, requisitions for and certificates of official searches, and regulating the practice of the registry in connection therewith;

(b) for providing for the mode of registration of a land charge (and in the case of a puisne mortgage, general equitable charge, estate contract, restrictive covenant or equitable easement by reference to the instrument imposing or creating the charge, interest or restriction, or an extract from that instrument) and for the cancellation without an order of court of the registration of a land charge, on its cesser, or with the consent of the person entitled to it, or on sufficient evidence being furnished that the land charge has been overreached under the provisions of any Act or otherwise ;

(c) for determining the date on which applications and notices shall be treated for the purposes of section 11 of this Act as having been made or given;

(d) for determining the times and order at and in which applications and priority notices are to be registered;

(e) for varying the relevant number of days for any of the purposes of section 11 of this Act;

(f) for enabling the registrar to provide credit accounting facilities in respect of fees payable by virtue of this Act;

(g) for treating the debiting of such a fee to a credit account maintained at the registry as being, for such purposes of this Act or of the rules as may be specified in the rules, payment of that fee;

(h)for the termination or general suspension of any credit accounting facilities provided under the rules or for their withdrawal or suspension in particular cases at the discretion of the registrar;

(j) for requiring the registrar to take steps in relation to any instrument or matter in respect of which compensation has been claimed under section 25 of the Law of Property Act 1969 which would be likely to bring that instrument or matter to the notice of any person who subsequently makes a search of the registers kept under section 1 of this Act or requires such a search to be made in relation to the estate or interest affected by the instrument or matter ; and

(k) for authorising the use of the index kept under this Act in any manner which will serve that purpose, notwithstanding that its use in that manner is not otherwise authorised by or by virtue of this Act.

(2) The power of the Lord Chancellor, with the concurrence of the Secretary of State, to make general rules under section 132 of the Bankruptcy Act 1914 for carrying into effect the objects of that Act shall include power to make rules as respects the registration and re-registration of a petition in bankruptcy under section 5 of this Act and a receiving order in bankruptcy under section 6 of this Act, as if the registration and re-registration were required by that Act.

17 Interpretation

Schedule 4 The Land Charges Act 1925, As Amended

Part VI Local Land Charges

15(1) Any charge (hereinafter called "a local land charge") acquired either before or after the commencement of this Act by the council of any administrative county, London borough, or urban or rural district, or by the corporation of any municipal borough, or by any other local authority under the Public Health Acts 1936 and 1937, the Highways Act 1959 or the Public Health Act 1961 or under any similar statute (public, general or local or private) passed or hereafter to be passed, which takes effect by virtue of the statute, shall be registered in the prescribed manner by the proper officer of the local authority, and shall (except as hereinafter mentioned in regard to charges created or arising before the commencement of this Act) be void as against a purchaser for money or money's worth of a legal estate in the land affected thereby, unless registered in the appropriate register before the completion of the purchase. For the purposes of this section any sum which is recoverable by a local authority under any of the Acts aforesaid from successive owners or occupiers of the property in respect of which the sum is recoverable shall, whether such sum is expressed to be a charge on the property or not, be deemed to be a charge.

(1A) The expenses incurred by the person entitled to a charge registrable under subsection (1) above in causing the charge to be registered in the appropriate register shall be deemed to form part of the charge, and shall be recoverable by him accordingly on the day for payment of any part of the charge next after such expenses are incurred.

(2) Except as expressly provided by this section, the provisions of the Land Charges Act 1972 relating to a land charge of Class B shall apply to a local land charge.

(3) As regards a local land charge, the registration by the proper officer shall (without prejudice to the right of the registrar also to register the charge if and when the prescribed application and information is made and furnished to him) take the place of registration by the registrar, and, in reference thereto, the proper officer of the local authority shall have all the powers and be subject to the same obligations as the registrar has or is subject to in regard to a land charge under the Land Charges Act 1972.

(4) Where a local authority has expended money for any purpose which, when the work is completed and any requisite resolution is passed or order is made, will confer a charge upon land, the proper officer of the local authority may in the meantime register a local land charge in his register against the land generally, without specifying the amount, but the registration of any such general charge shall be cancelled within the prescribed time not being less than one year after the charge is ascertained and allotted, and thereupon the specific local land charges shall, unless previously discharged, be registered as of the date on which the general charge was registered.

(5) Nothing in this section operates to impose any obligation to register any local land charge created or arising before the commencement of this Act except after the expiration of one year from such commencement or to discharge a purchaser from liability in respect of any local land charge which is not for the time being required to be registered.

(7) The foregoing provisions of this section shall apply to—

(b) any prohibition of or restriction on the user or mode of user of land or buildings imposed by a local authority after the commencement of this Act by order, instrument, or resolution, or enforceable by a local authority under any covenant or agreement made with them after the commencement of this Act or by virtue of any conditions attached to a consent, approval, or licence granted by a local authority after that date, being a prohibition or restriction binding on successive owners of the land or buildings, and not being—

(i) a prohibition or restriction operating over the whole of the district of the authority or over the whole of any contributory place thereof ; or

(iii) a prohibition or restriction imposed by a covenant or agreement made between a lessor and lessee, as if the resolution, authority, prohibition or restriction were a local land charge ; and the same shall be registered by the proper officer as a local land charge accordingly.

(7A) Where any matter is registrable both in a register kept under this Act and in one or more of the registers kept under the Land Charges Act 1972, it shall be sufficient if it is registered in one register, and if it is so registered the person entitled to the benefit of it shall not be prejudicially affected by the provisions of this Act or that Act applying to any other register.

(7B) The registration of a local land charge may be vacated pursuant to an order of the court.

(8) This section applies to local land charges affecting registered as well as unregistered land.

Part VII Searches

16 Any person may search in any register or index kept in pursuance of this Act on paying the prescribed fee.

Part VIII General

19 The Lord Chancellor may, with the concurrence of the Treasury as to fees, make such general rules as may be required for carrying this Act into effect, and in particular—

(a) for prescribing the mode of registration of a charge, whether by reference to the estate owner or to the land affected or otherwise ;

(b) for prescribing the proper officer to act as local registrar, and making provision as to official certificates of search to be given by him in reference to subsisting entries in his register;

(c) for determining the effect of an official certificate of search in regard to the protection of a purchaser, or a solicitor, trustee or other person in a fiduciary position, and for prescribing the fees to be paid for any such certificate or for a search ;

(d) for adapting the provisions of section 11 of the Land Charges Act 1972 to local land charges ;

(e) for providing for the cancellation without an order of the court of the registration of a local land charge, on the cesser thereof, or with the consent of the person entitled thereto ;

(f)f or prescribing the fees, if any, to be paid for the cancellation of any entry in the register ;

(g) for providing that any enactment which was contained in Part II of the Land Registration and Land Charges Act 1971, and any specific repeal made by that Act in so far as it reproduced the effect of any such enactment, shall have effect in relation to local land charges."

20 In this Act, unless the context otherwise requires, the following expressions have the meanings hereby respectively assigned to them that is to say:—

(2) " court" means the High Court of Justice or the county court where that court has jurisdiction ;

(4) " estate owner " and " legal estate " have the same meanings as in the Law of Property Act 1925 ;

(6) " land " includes land of any tenure and mines and minerals, whether or not severed from the surface, buildings or parts of buildings (whether the definition is horizontal, vertical or made any other way) and other corporeal hereditaments, also a manor, an advowson and a rent and other incorporeal hereditaments, and an easement, right, privilege or benefit in, over or derived from land, but not an undivided share in land ; and " hereditament" means real property which, on an intestacy occurring before the commencement of this Act, might have devolved on an heir.

(8) " purchaser" means any person (including a mortgagee or lessee) who, for valuable consideration, takes any interest in land or in a charge on land, and "purchase" has a corresponding meaning ;

(9) " prescribed " means prescribed by rules made pursuant to this Act;

(10) " registrar" means the Chief Land Registrar and " registered land" has the same meaning as in the Land Registration Act 1925.

24 Without prejudice to the provisions of section 38 of the Interpretation Act 1889:—

(a) nothing in this repeal shall affect any entry in a register made under any enactment so repealed, but the registration shall have effect as if made under this Act;

(c) references in any document to any enactment repealed by this Act shall be construed as references to this Act or to the corresponding enactment in this Act.

25 The provisions of this Act bind the Crown, but nothing in this Act shall be construed as rendering land owned by or occupied for the purposes of the Crown subject to any charge to which, independently of this Act, it would not be subject.

26(1) This Act may be cited as the Land Charges Act 1925. (3) This Act extends to England and Wales only.

NCSC

ROYAL OPENING - Her Majesty The Queen opened the NCSC on the 17th of

February 2017. There are several agencies in the UK that are supposed to

tackle fraud, cyber crime, drugs, sex trafficking and money laundering,

but when you ask any one of them to take a look at corruption in

Wealden-land, they don't appear too anxious to open a case file. It's

more a case of pass the buck .... and keep passing it ... until the

complainant fades away. Sorry to have to report this to you Your

Majesty, but it is the truth the whole truth and nothing but the truth -

so help me God.

FOR

GAIN AND LOSS SEE THE FRAUD ACT 2006

A "gain" or a "loss" is defined to consist only of a gain or a loss in money or property (including

intangible

property), but could be temporary or permanent. A "gain" could be construed as gaining by keeping their existing possessions, not just by obtaining new ones, and loss

including loss of expected acquisitions, as well as losses of already-held

property - such as use - as opposed to non-use.

Hence, the refusal of a reasonable use becomes the initial mechanism

whereby corrupt councils seek to devalue a property that they are

attempting to acquire for a favoured neighbour or property developer.

Section

10 extract of a Consent Order in Case No: SD16 of 2003, in the

Eastbourne County Court. This is an Agreement between Nelson Kruschandl

and Wealden District Council, that Mr Kruschandl alleges

this council have breached concerning recognition of and the future of Herstmonceux

Museum. Certain documents have been provided to us so that we can

say to you that these documents are genuine.

Fraud

is any statement or action that deceives another person, and in so doing

causes a loss to the victim. Fraud, is also the failure to do something

that is required in a position of authority - such as failing to seek

advice from the County Archaeologist and English Heritage in accordance

with Government Circulars. In this case it is alleged that Wealden only

put forward one side of an argument, and that they failed to seek the

proper assurances from the experts, as per Government guidance. This is

of course a crucial omission

on the part of those officers involved in the preparations of: 1. An enforcement

report to the Members 2. Prior to service of an Enforcement Notice, and

3. An appeal where an Inspector will be making a decision and needs

accurate facts on the table in order to make a decision that is safe. If

the facts upon which a decision is based are incorrect (false or have

been crafted) then the decision reached is ultra vires (invalid).

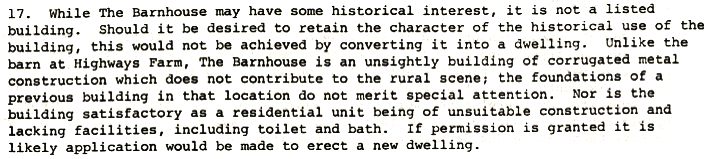

Consider

then paragraph 17 of the Decision Letter from R P Dannreuther in 1987.

In this paragraph the Inspector says that: "the foundation of a

previous building do not merit special attention." This is a

crucial error on the part of Dannreuther, because he has been persuaded

that the building he is looking at is not the original generating

building, but a building of "corrugated metal construction"

built over foundations from another building that has no archaeological

merit. This would never have happened if Wealden had done their duty and

consulted the experts. Whether or not this was deliberate is irrelevant,

as officers of the Court they were obliged to follow the correct

procedure. Not to do so is both improprietous and maladministration -

but more importantly, deprived the appellant of his right to a fair

hearing under Article 6

- thus is also

a human rights violation - that travels back in time if a Council fail

to correct any decision or data entry that is erroneous and carries

forward that which is now a violation under the Human Rights Act 1998.

Consider

now paragraph 20, where Inspector Dannreuther says: The building itself,

because of its materials and construction is an unattractive feature in

the rural scene." Here again, the Inspector has erred in fact,

because he has incorrectly been advised by George

Morham White and Thomas

William Hoy that the corrugated metal is the

construction method. Whereas, the building is of timber construction

(like many other barn conversions) and was merely sheathed in corrugated

metal during WWII hostilities as a

fire precaution. That metal covering

has now gone.

FRAUD

CONCEALMENT - One

way of hiding a fraud, is to do nothing that might reveal that fraud,

such as to compile a list of local building of interest, when one knows

that they have obtained a decision by what is now defined as a statutory

fraud. Perpetuating known incorrect decisions to cause a person loss,

brings the offence from 1986 into frame for prosecution in 2014.

Victorio

Patrick Scarpa, Christine Nuttall, David Phillips & Charles (Charlie) Lant

Kelvin

Williams, J. Douglas Moss and Ian M. Kay

The

above picture is of Victorio

Patrick Scarpa over 10 years ago, also Christine

Nuttall & David Phillips. David

Phillips was still working for WDC as of 2014. He was the enforcement

officer working with Vic Scrapa concerning the alleged ongoing malicious

prosecution. How many

other officers might have been involved, or know enough to be able to

blow the whistle? We know Christine Nuttall and Vic

Scarpa were the solicitors preparing papers for this council for the

cases against Mr Nelson

Kruschandl.

..

1.

Introduction

Under

section 1 of the Land Charges Act 1972, the Land Charges Department keeps

the following registers:

-

a

register of land charges

-

a

register of pending actions and pending actions in bankruptcy

-

a

register of writs and orders affecting land and writs and orders in

bankruptcy

-

a

register of deeds of arrangement affecting land

-

a

register of annuities

See

Appendix

D: Land Charges registers for further details.

The

Land Charges Department also keeps an index whereby all entries made in

any of the registers can readily be traced.

The

primary task of the Land Charges Department is to protect the interest of

a person, or an organisation in unregistered land and to maintain the

bankruptcy index for England and Wales.

The

land charges index does not record ownership of unregistered land. This is

because a person who owns unregistered land has title deeds which may be

produced as proof of ownership. First mortgages are not registered at the

Land Charges Department, because the mortgagee of unregistered land who

has a first mortgage holds the title deeds as security. (This prevents the

owner of the land from selling the land without contacting the mortgagee.)

However,

there are many other situations where someone has an interest in the land

but does not hold the title deeds as security. These may be interests such

as second or subsequent mortgages (where the mortgagee does not hold the

deeds), restrictive covenants, estate contracts including option

agreements, and matrimonial or civil partnership home rights. This is

where the Land Charges Department has a vital role. The person or

organisation with the interest should apply to register their interest

with the Land Charges Department.

Please

note that there is no provision in the Land Charges Act 1972 for the

protection by registration of an interest under a trust of land or

settlement.

See

Applications

for registration for further details.

If

the person who has an interest which should be protected by registration

fails to register it under the Land Charges Act 1972, the interest will be

void against certain purchasers of the land. As to non-registration of

land charges see section 4 of the Land Charges Act 1972 and, for example,

Midland Bank Trust Co Ltd v Green HL [1981] AC 513, [1981] 1 All ER 153.

Registration

of any instrument or matter under the Land Charges Act 1972 does not,

however, confer validity upon it. The registrar is not concerned to

inquire into or otherwise verify the accuracy or validity of any

application made to him (see rule 22 of the Land Charges Rules 1974).

The

land charges registers are open and anyone may apply to search them

(section 9 of the Land Charges Act 1972). Purchasers’ conveyancers

acting in the purchase of unregistered land should, as a matter of course

apply for a search against the vendors and previous owners of the land to

determine whether there are any land charges that have been registered and

to obtain the details if there are. They can then ensure, for example,

that any mortgage that is revealed is cleared. They will also know how to

advise their clients on any other matters, such as restrictive covenants

or equitable easements, that may be revealed.

In

addition, anyone proposing to lend money can check that the borrower is

not bankrupt. When acting for a lender a ‘bankruptcy only’ search

should be made against a borrower even if a registered estate in land is

being purchased.

This

guide explains:

-

how

to make different types of application

-

the

information you must provide

-

the

different types of form (for postal applications)

-

the

information you will receive in an acknowledgment, certificate of the

result of search or office copy

2.

Applications for registration (rules 5 and 14(3) of the Land

Charges Rules 1974)

You

must lodge applications for registration, renewal of registration,

priority notice or rectification in the prescribed form as follows:

-

K1

Application for registration of a Land Charge (other than Class F)

-

K2

Application for registration of a Land Charge of Class F

-

K3

Application for registration of a Pending Action

-

K4

Application for registration of a Writ or Order

-

K6

Application for registration of a Priority Notice

-

K7

Application for the renewal of a registration (other than a Land

Charge of Class F)

-

K8

Application for the renewal of a registration of a Land Charge of

Class F

-

K9

Application for rectification of an entry in the register

No

deed, document or plan should be lodged with the application unless

provided for by the Land Charges Rules or the appropriate form or a notice

under Schedule 3 (rule 21 of the Land Charges Rules 1974).

Form

K10 (Continuation of an application) may be used if there is

insufficient space on the above forms for details of the application.

2.1

Completing the application

Because

applications are scanned, it is imperative that you complete each

application form legibly and accurately. The land charges registers and

index are compiled from the information given in applications,

consequently any error in the particulars given, however slight, may lead

to highly important information not being disclosed in a subsequent

search.

This

almost certainly would be to the detriment of the chargee (see Diligent

Finance Co Ltd v Alleyne and Another [1972] 23 P. & C.R. 346; ct. Oak

Co-operative Building Society v Blackburn and Others [1968] Ch. 730 C.A.,

reversing [1967] Ch.1169).

2.1.1

Names

You

must give the full names in your application:

-

for

individuals: enter the forename(s) and surname in the spaces provided

-

title

or rank: see Titles

for details of how to enter these

-

names

other than individuals: see Names

other than private individuals for details of how to enter these

2.1.2

Description of the land charged

You

must always provide the name of the administrative area in which the land

is located. This means that you must specify the relevant unitary

authority or, where the land is not within a unitary authority, the county

and district. See Appendix

C: administrative areas in England and Wales used by the Land Charges

Department for more details.

In

addition, you must provide a short description which, so far as

practicable, identifies the location of the land. Normally the whole of

the description of the land is included as part of the entry in the index.

It is then reproduced in any certificate of the result of search that

discloses the entry.

2.1.3

Applications pursuant to a priority notice

In

order to attract the priority conferred under a priority notice you must

state, in the space provided, the official reference number of that

priority notice (section 11 of the Land Charges Act 1972). See Application

for registration of a priority notice for details of how to apply for

a priority notice).

2.1.4

Certification (rule 13(2) of the Land Charges Rules 1974)

You

should note that registration under the Land Charges Act 1972 has no

application to registered land. The Land Charges Act 1972 does not require

the registrar to ascertain whether or not an instrument or matter affects

registered land (section 14(2) of the LCA 1972). When you apply for

registration you must certify that the estate owner’s title is not

registered at HM Land Registry.

2.1.5

Rejection of applications

The

Land Charges Department will reject any applications for registration

where:

-

the

application form is not signed

-

the

application is for the wrong class of land charge

-

he

application discloses an interest under a trust or settlement

-

fees

are not enclosed and there is no key number on the form

LINKS

https://www.gov.uk/land-charges-applications-for-registration-official-search-office-copy-cancellation/practice-guide-63

http://e-lawresources.co.uk/Land/Midland-Bank-v-Green.php

http://www.legislation.gov.uk/ukpga/1972/61/enacted

|