|

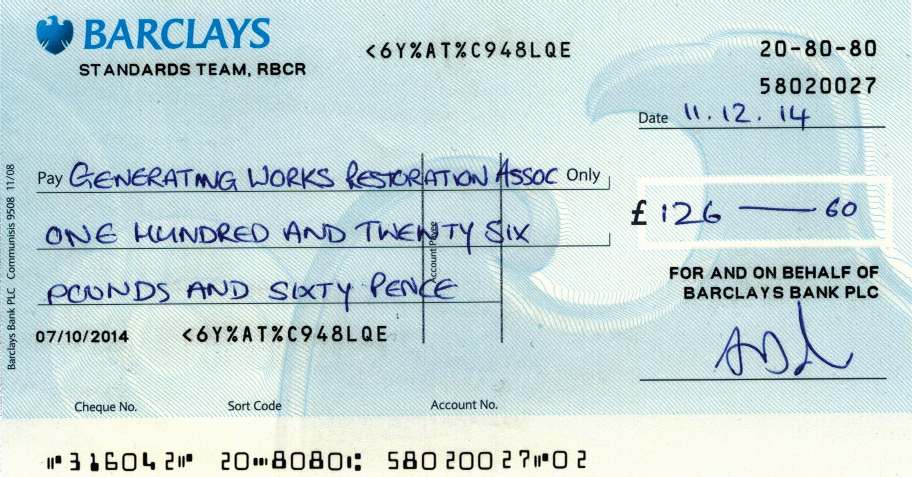

BARCLAYS BANK PLC

|

||

|

The Fraud Act 2006 (c 35) is an Act of the Parliament of the United Kingdom. It affects England and Wales and Northern Ireland. It was given Royal Assent on 8 November 2006, and came into effect on 15 January 2007.

The Fraud Act 2006 should be read in conjunction with the The Serious Organised Crime and Police Act 2005 and the Proceeds of Crime Act 2002.

FRAUD ACT 2006

Section 4 - Fraud by abuse of position [such as a planning or police officer]

(1) A person is in breach of this section if he —

(b)

dishonestly abuses that position, and (c)

intends, by means of the abuse of that position— (i)

to make a gain for himself or another, or (ii)

to cause loss to another or to expose another to a risk of loss. (2)A person may be regarded as having abused his position even though his conduct consisted of an

omission rather than an act.

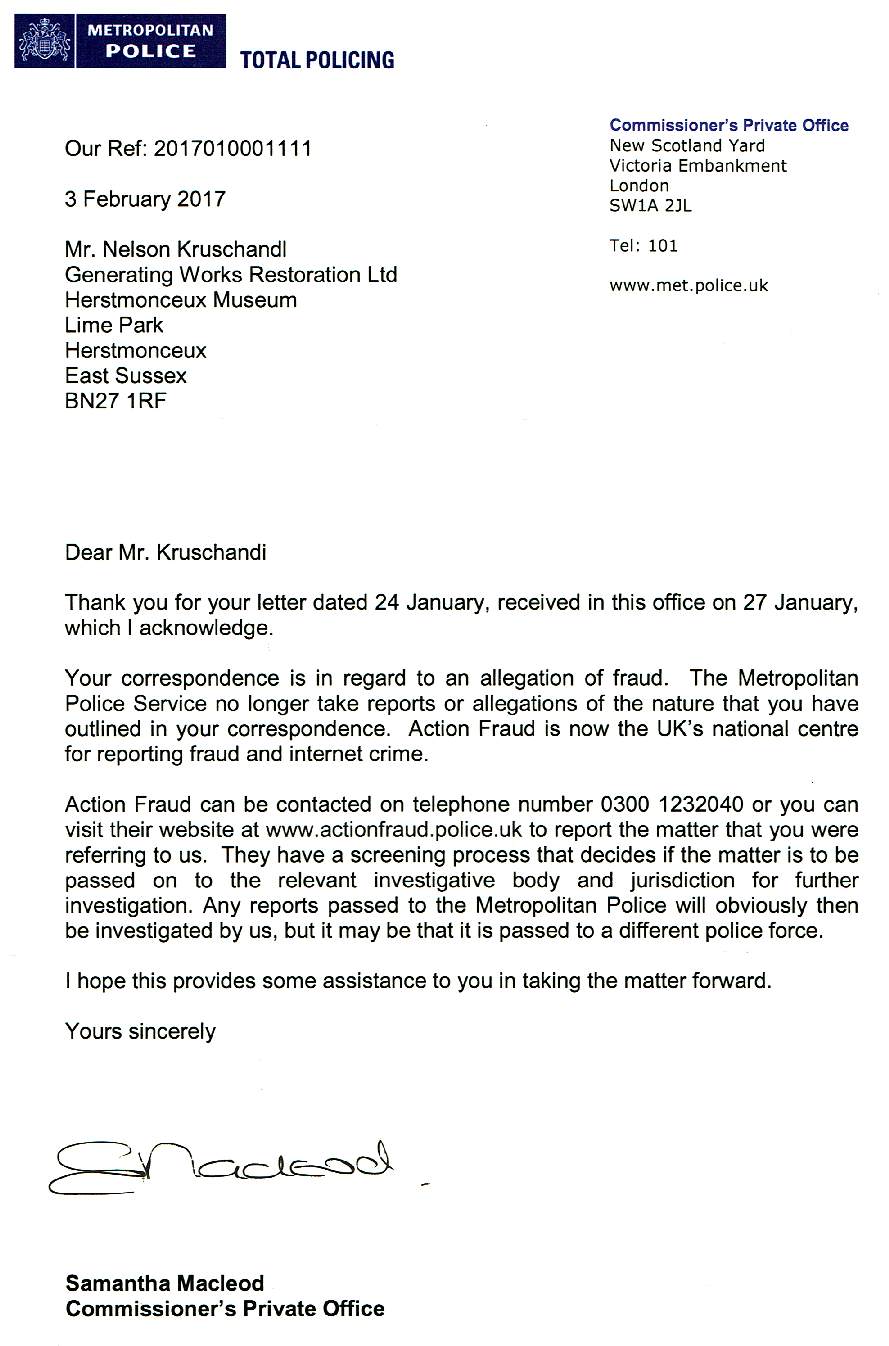

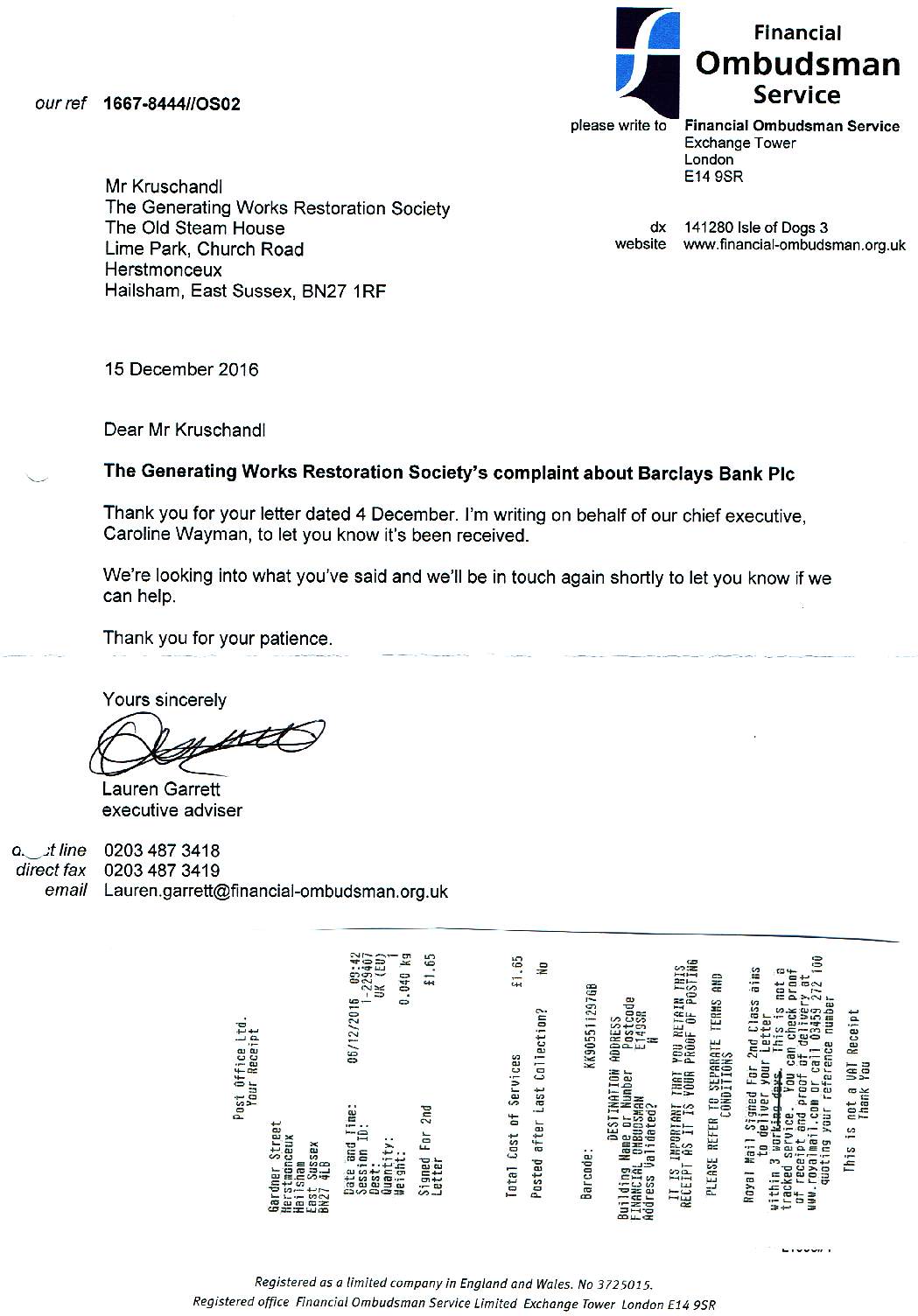

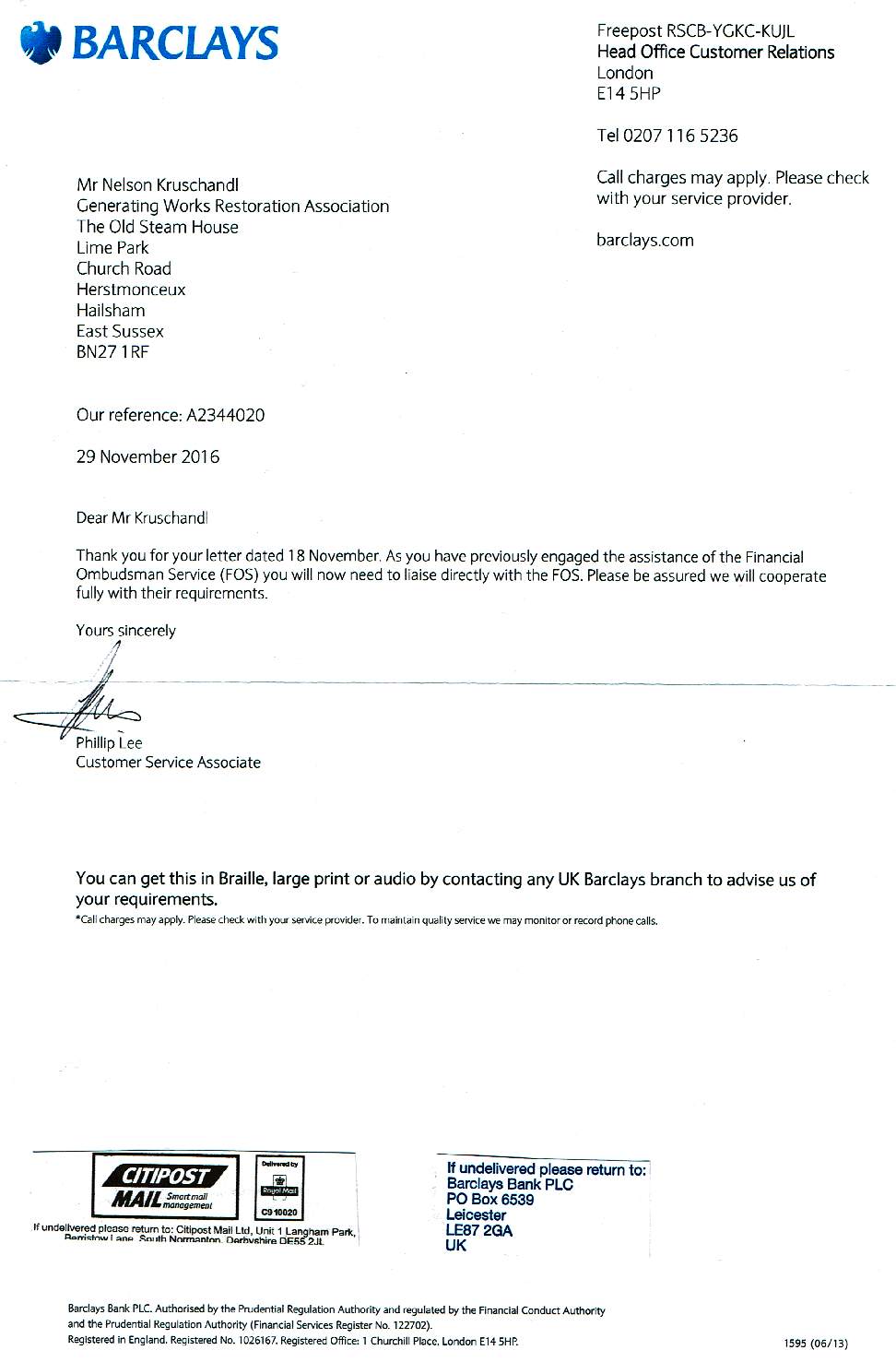

THEY ARE ALL AT IT - British banks are stealing money from accounts and causing significant problems (losses) for small firms and not for profit organisations. It may only be a few pounds here and another hundred there, but it all mounts up and the British police are not at all interested in mounting any kind of prosecution - or forcing the directors of these banks to accept a caution.

If you have suffered any loss, tangible or intangible, we would like to hear from you. Take a look at section 4 of the Fraud Act 2006. They are in positions of trust, but are abusing your trust - knowing that they will get away wi

PURPOSE

The Act gives a statutory definition of the criminal offence of fraud, defining it in three classes - fraud by false representation, fraud by failing to disclose information, and fraud by abuse of position. It provides that a person found guilty of fraud was liable to a fine or imprisonment for up to twelve months on summary conviction (six months in Northern Ireland), or a fine or imprisonment for up to ten years on conviction on indictment. This Act largely replaces the laws relating to obtaining property by deception, obtaining a pecuniary advantage and other offences that were created under the Theft Act 1978. These offences attracted much criticism for their complexity and difficulty in proving at court. Much of the Theft Act 1978 has been repealed, however, the offence of making off without payment, defined under section 3 has not been affected.

GAIN AND LOSS

NCSC ROYAL OPENING - Her Majesty The Queen opened the NCSC on the 17th of February 2017. To mark the launch of the National Cyber Security Centre, listen to CEO Ciaran Martin, Technical Director Dr Ian Levy, Chancellor Phillip Hammond and DCMS Minister Matt Hancock talk about how the NCSC aims to make the UK the best possible place to live and work online.

LINKS & REFERENCE

http://www.actionfraud.police.uk/ https://www.ncsc.gov.uk/ http://www.legislation.gov.uk/ukpga/2006/35/contents http://en.wikipedia.org/wiki/Fraud_Act_2006

|

||

FAIR USE NOTICE

This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, scientific, and social justice issues, etc. We believe this constitutes a 'fair use' of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. |

||

|

This site is protected under Article10 of the European Convention on Human Rights and Fundamental Freedoms. |

||